We are offering drop-in appointments across all our developments; however, should you wish to have dedicated time with our sales advisor, we encourage you to book ahead. Come and visit us.

Get more information and updates regarding this development via:

Are you happy for us to contact you about other developments and special offers via:

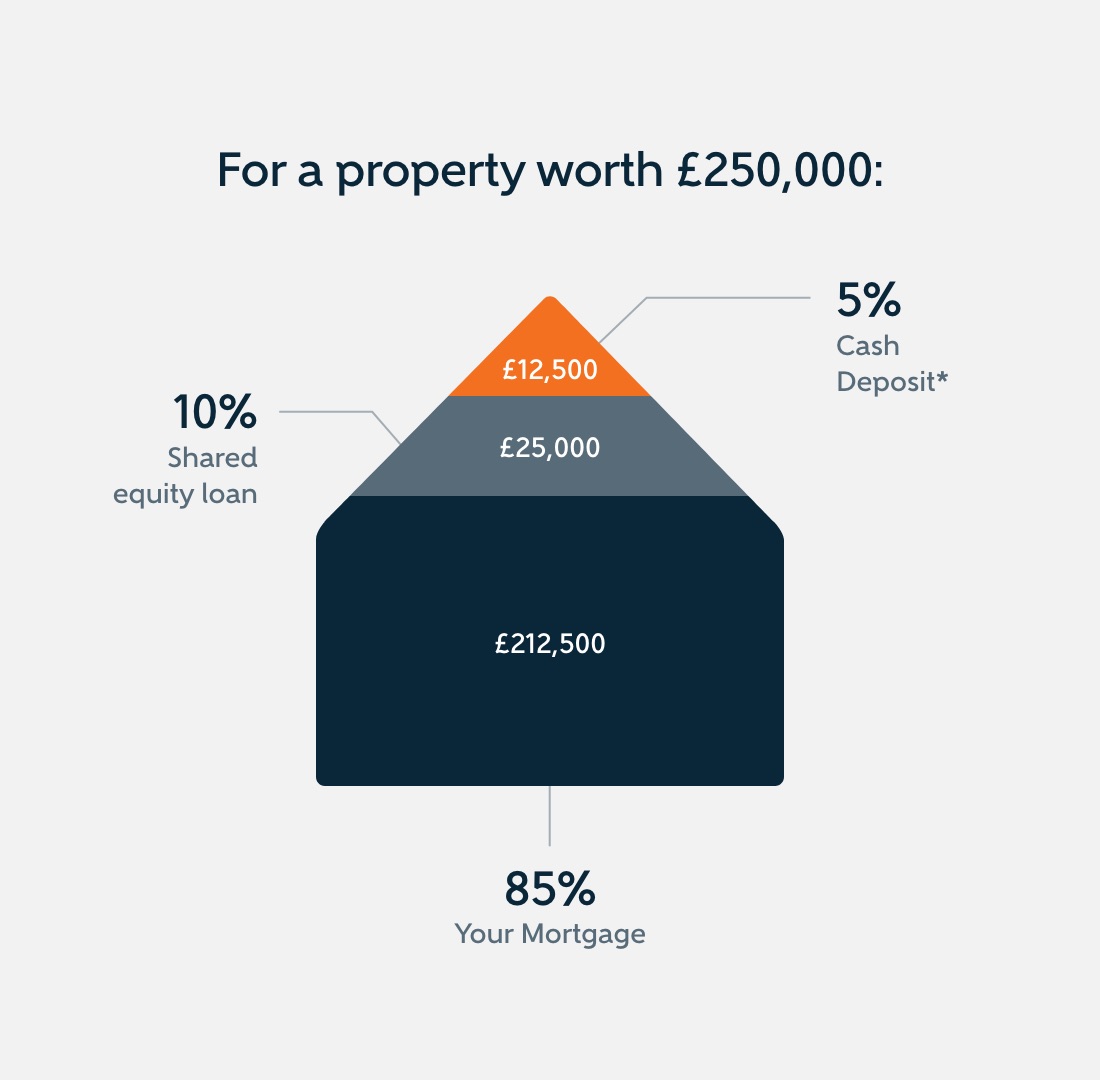

The First Home Fund is available across Scotland and provides a government-backed equity loan of up to £25,000 to first-time buyers towards their new home. To take part in the scheme you need a minimum deposit of 5% and an agreed repayment mortgage of at least 25% of your home’s purchase price. The new round of funding open for business on 1st April 2021, with eligible home purchases completing between then and the end of the financial year on 31st March 2022.

The First Home Fund is backed by the Scottish Government and is available to all first-time buyers towards a new-build, or existing property. Designed to help people move on to the property ladder, the scheme provides a payment of up to £25,000 (or a maximum of 49% of the valuation/purchase price) to eligible buyers towards the cost of a home. There is no upper limit to the cost of the property you can buy. The fund reopens to applications on 1st April 2021 and covers home purchases completing during the period 1st April 2021 until 31st March 2022.

Applications to the fund must be made through an administering agent and if successful, will be subject to a fee. Successful applicants will receive an award letter and missives should be concluded within three months of the date of this letter. Settlement should take place within six months of missives being concluded.

Successful applicants will own the property outright and no monthly payments, or interest are due to the government, however the loan must be repaid when the property is sold (or you can increase your share of the equity while you live in the property).

In essence, this means if you receive a 10% equity loan from the Scottish Government then when you sell your home you will repay 10% of the sale price, which may be higher, or lower, than the purchase price.

Applicants to the First Home Fund will not be able to apply to other home ownership schemes in Scotland: Help to Buy (Scotland), New Supply Shared Equity and Open Market Shared Equity. An independent financial adviser will be able to advise whether or not this scheme is suitable for you, or whether one of the other shared equity schemes operating in Scotland is more appropriate.

The First Home Fund is open to first-time buyers in Scotland. To be eligible for the scheme, you should have a 5% deposit towards your new home and an agreed repayment mortgage. You, or the person you are purchasing the property with, must be a first-time buyer and the property must be your sole residence.

Find my homeFor information about appointing an independent financial advisor (IFA), visit: https://www.fca.org.uk/consumers/finding-adviser

The scheme is open to first-time buyers and you must live in the property you buy (it must be your sole residence).

You cannot apply to the fund if you have an application in progress to Help to Buy (Scotland) Affordable New Build, Help to Buy (Scotland) Smaller Developer, New Supply Shared Equity or Open Market Shared Equity schemes. If you have applied to any of these schemes then you must withdraw your application before applying to the fund.

Your mortgage must be a repayment mortgage and you must pay at least 5% deposit.

If you wish to remortgage you must first obtain the agreement of the Scottish Government.

The fund is open to both new-build and existing homes and there is no price limit on the cost of the property you purchase.

You can borrow up to £25,000, (or up to 49% of the valuation figure, or the purchase price, whichever is lower).

You own 100% of your home, the government does not hold any legal title to your property.

Yes the loan is interest-free.

You would ordinarily pay back the equity loan when you sell the property. You can pay back the loan while you are still living in the property by increasing your share of the equity by at least 5% in each instance. If however your existing equity share is 90%, or above, you can only increase your equity share to 100%. You will have to pay the costs incurred by increasing your share of the equity.

The loan is an equity loan, which means that if your home has increased in value when you sell it then the amount you repay to the Scottish Government will also increase. Equally, if your property has decreased in value then the amount you repay to the government will be less than the initial amount borrowed. It is the percentage of the equity loan that is important, so if you borrowed 10% of the valuation price of your property when you bought it, you will repay 10% of the valuation price when you sell it.

All you need when it comes to finding your new home

*Subject to individual lender requirements. Available until March 2021. Terms and conditions apply. For more information, visit https://linkhousing.org.uk/firsthomefund.