We are offering drop-in appointments across all our developments; however, should you wish to have dedicated time with our sales advisor, we encourage you to book ahead. Click here for further details.

Get more information and updates regarding this development via:

Are you happy for us to contact you about other developments and special offers via:

The Help to Buy scheme has now ended. If you’re an existing Help to Buy customer, you can find details of the scheme below:

Applications for the Government’s Help to Buy scheme are no longer being accepted as of Monday 31st October 2022. Buyers who have already reserved a home using the scheme have until Friday 31st March 2023 to complete their purchase.

If you have already bought your home using Help to Buy and would like further information about the scheme, please refer to the information on this page, or visit the gov.uk website.

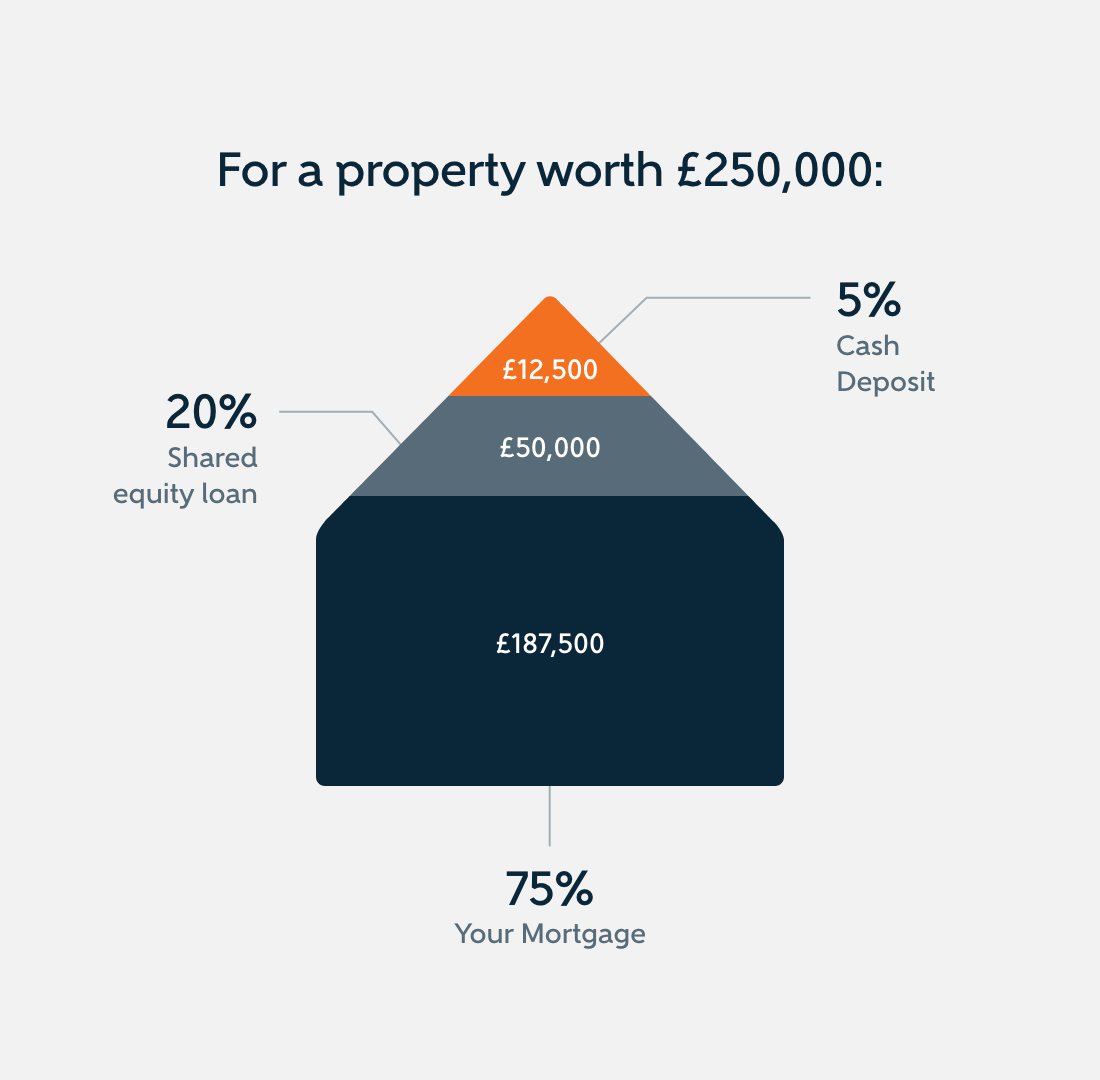

With a Help to Buy equity loan, first-time buyers could purchase a newly built home with just a 5% deposit.

As part of the scheme, the Government offered to lend homebuyers up to 20% of the cost of their home (40% in London), meaning that they'd only need a 75% mortgage to make up the rest (55% in London).

For the first five years, the Government’s share of the loan is completely interest free. Buyers are obligated to repay the Help to Buy loan after 25 years, or earlier if they sell their home, repaying the same percentage of the proceeds of the sale (i.e. if the buyer received 20% on purchase, they must pay 20% of the proceeds of the future sale).

The Help to Buy scheme was available to first-time buyers only, subject to eligibility, and was restricted by regional price caps.

The scheme ended on 31st October 2022.

The scheme was available on new build homes with the following regional price caps in England:

Help to Buy was available to first-time buyers looking to buy a new-build home as their only residence.

Find my homeThe property purchased using Help to Buy must be your only home and you must live in it.

You must be a first-time buyer and fit the eligibility criteria in order to quality for Help to Buy.

You cannot use Help to Buy in conjunction with part exchange or on an existing home.

Any mortgage used in conjunction with Help to Buy must be a repayment mortgage (not an interest-only mortgage).

You must seek permission to extend, or alter the property purchased using Help to Buy.

Your new home must be valued within the regional price cap for your area.

The scheme was only available to new build homes, and regional price caps did apply. See the diagram above, or call one of our sales advisors for more information on how the Help to Buy scheme may differ in your area.

A 5% deposit was required for the scheme

The amount you could have borrowed varies by country and area. In England and Wales, you could borrow up to 20% of the cost of the property, though in London this figure was up to 40%. Maximum property prices under the scheme also vary by region in England.

Help to Buy was interest-free for the first five years, however, there is a management fee of £1 per month until the loan is repaid. After five years interest will apply – currently 1.75% in year six, then 1.75% and any increase in the Retail Prices Index (RPI) plus 1% each subsequent year.

You must repay the equity loan after 25 years, or if earlier, when you sell your home.

You can pay back all, or part, of the loan at any time, with a minimum of 10% of the prevailing market value of your home.

Help to Buy works slightly differently depending on the scheme you choose.

Make sure to get the right information.

No matter your circumstances, we have a range of available schemes designed to meet your needs.

Move into your new home quickly and easily with our comprehensive service.

Take advantage of our part-exchange scheme – the stress-free way to move home.

The low-deposit mortgage solution suitable for first-time buyers. Move now with a 5% deposit.

All you need when it comes to finding your new home

*YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR ANY OTHER DEBT SECURED ON IT. Help to Buy is subject to the Homes and Communities Agency’s (HCA) terms and conditions and is available on new build homes on selected Bellway developments where the property represents your only residence. Help to Buy is available to first-time eligible buyers only and is subject to maximum regional price caps. HomeBuy agent eligibility checks are required. The equity loan is interest free for the first five years. If you are an eligible first-time buyer, the Government will lend you a minimum of 5% and up to 20% (or up to 40% in London) of the market value of your new build home. You start to pay interest from year six, on the fifth anniversary of your equity loan and this is calculated at a rate of 1.75% of the equity loan amount. The interest rate will rise each year thereafter in April by the Consumer Price Index (CPI), plus 2%. The interest you pay during the life of the equity loan does not reduce the amount you owe. The amount of interest you pay will reduce if you make part repayments. Interest will be worked out on the amount of equity loan left to pay. You may be charged interest on overdue money and pay administration fees to make changes to your equity loan. When your equity loan starts you must pay a £1 monthly management fee; this is paid for the life of your equity loan. When you take out your equity loan, you agree to repay it in full, plus interest and management fees. You must repay your equity loan in full: at the end of the equity loan term (normally 25 years), when you pay off your repayment mortgage, when you sell your home and if you do not comply with the terms set out in the equity loan contract and you are asked to repay the loan in full. Help to Buy operates under terms and conditions imposed by the HCA and may be subject to change. Please visit www.helptobuy.gov.uk for further information. Help to Buy cannot be used in conjunction with other schemes. Information correct at time of broadcast. Please see www.helptobuy.gov.uk/equity-loan/eligibility/ for further information. †Terms and conditions apply.